How To Fix Water Heater Rust?

How To Fix Water Heater Rust?

Rust in water heaters is a common problem caused by the interaction of water and metal, leading to corrosion. ...

Top Reasons Why Your Refrigerator Is Not Cooling

Top Reasons Why Your Refrigerator Is Not Cooling

A refrigerator is an essential appliance in any household, and when it stops cooling correctly, it can cause a ...

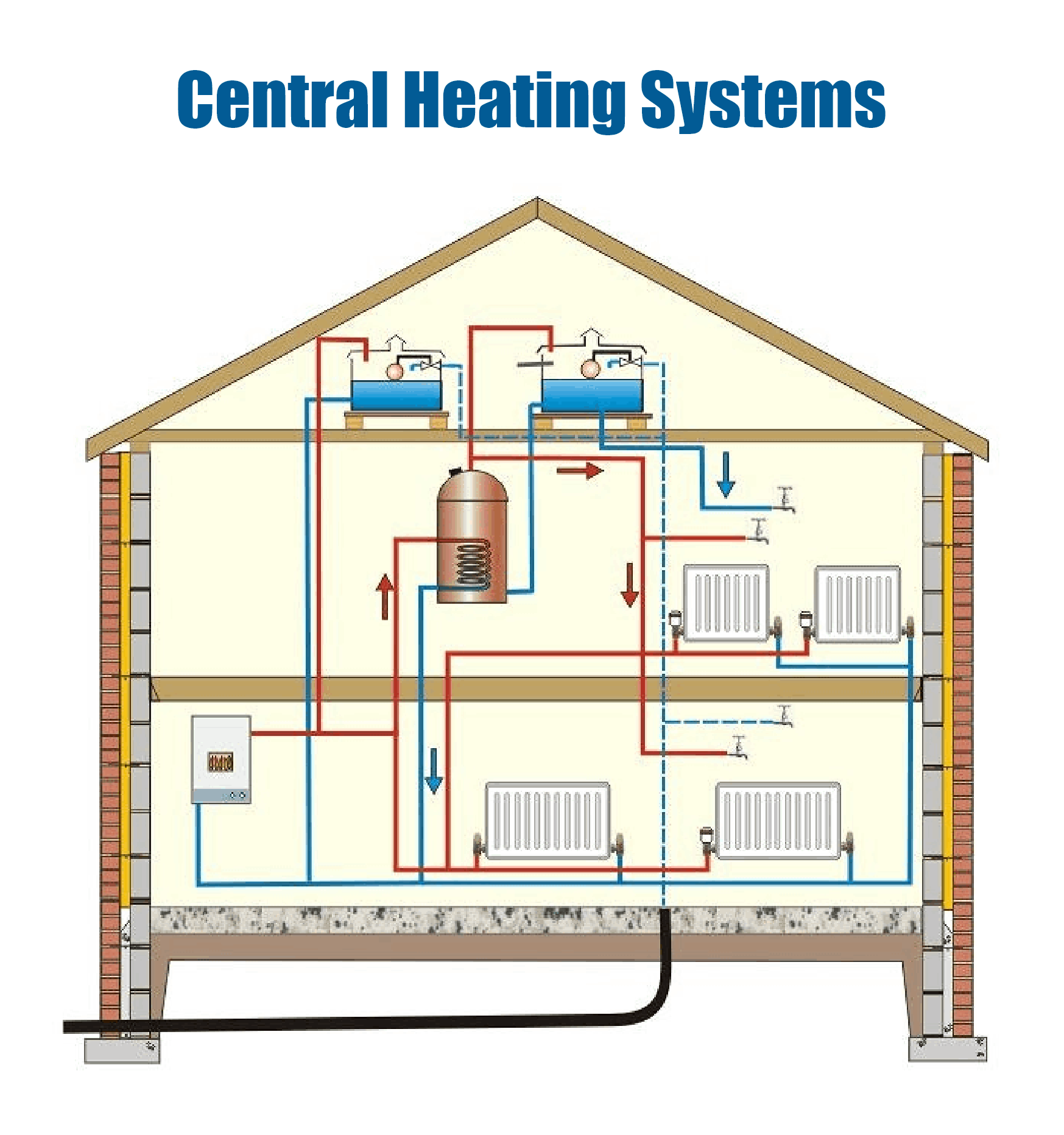

Comprehensive Guide To Central Heating Systems

Comprehensive Guide To Central Heating Systems

Imagine stepping into a toasty home on a chilly winter day. The comfort of central heating is a modern marvel, ...

How To Fix A Freezer That’s Not Working?

How To Fix A Freezer That’s Not Working?

A malfunctioning freezer can be a source of significant stress. Visions of thawed and spoiled food dance in yo ...

Common thermostat issues and fixes

Common thermostat issues and fixes

Thermostats are essential for maintaining a comfortable indoor environment, whether in a residential or commer ...

Quick Fixes for Air Conditioner Leaks

Quick Fixes for Air Conditioner Leaks

Air conditioner leaks can be a nuisance, affecting the efficiency of your cooling system and potentially damag ...