Last updated: August 7th, 2024

Last updated: August 7th, 2024

Homeowners’ Guide To Refrigerator Maintenance: Common Issues, Quick Fixes, & Best Practices

Does your fridge sound like a malfunctioning orchestra, or is your once-crisp produce wilting faster than a forgotten dream? Fear not, fellow homeowner! This guide is your culinary knight in shining armor, here to vanquish common refrigerator woes. With simple explanations and easy-to-follow tips, we’ll transform you from a fridge-fumbling novice into a maintenance master.

From conquering cryptic noises to banishing baffling leaks, this guide equips you with the knowledge to tackle those refrigerator troubles, keeping your food fresh and your wallet happy. So, grab a wrench (or maybe just a screwdriver), and let’s get your fridge fighting fit!

Common Refrigerator Problems: A Detailed Breakdown

Refrigerators are vital kitchen appliances, keeping food fresh and safe for consumption. But like any machine, they can experience malfunctions. Here’s a breakdown of common refrigerator problems in US households, along with their technical causes and solutions:

1. Refrigerator Not Cooling Properly

A warm refrigerator can wreak havoc on your groceries and peace of mind. To troubleshoot this issue effectively, we must investigate the reasons behind a malfunctioning cooling system.

Here’s a breakdown of the culprits and solutions.

Probable Causes For Refrigerators Not Cooling Properly

- Defrost System Malfunction: Frost buildup on the evaporator coils prevents proper air circulation and heat exchange. This can be due to a faulty defrost timer, heater, or temperature sensor.

- Low Refrigerant Level: Refrigerators use refrigerant gas to absorb heat from the interior. A leak or low refrigerant level can reduce the system’s cooling capacity.

- Air Circulation Issues: Blocked air vents within the refrigerator or a faulty condenser fan can impede cold air circulation, leading to uneven cooling or temperature fluctuations.

- Dirty Condenser Coils: Dust and grime buildup on the condenser coils at the back of the refrigerator reduces their ability to dissipate heat efficiently.

Troubleshooting Tips

- Defrost System: If the automatic defrost cycle isn’t functioning, manually defrost the refrigerator. Check the timer, heater, and sensor for signs of wear or failure and consider replacing them if necessary (consult a qualified appliance repair technician for complex repairs).

- Refrigerant Level: Adding refrigerant is a job for a licensed professional. They can diagnose the leak, repair it, and recharge the system with the correct amount of refrigerant according to the manufacturer’s specifications.

- Air Circulation: Ensure food items don’t block air vents inside the refrigerator. Clean the condenser coils regularly with a vacuum cleaner to remove dust and debris. A properly functioning condenser fan is crucial for optimal air circulation.

- Check Temperature Settings: Ensure the temperature controls are set to the recommended settings (around 38°F for the refrigerator and 0°F for the freezer).

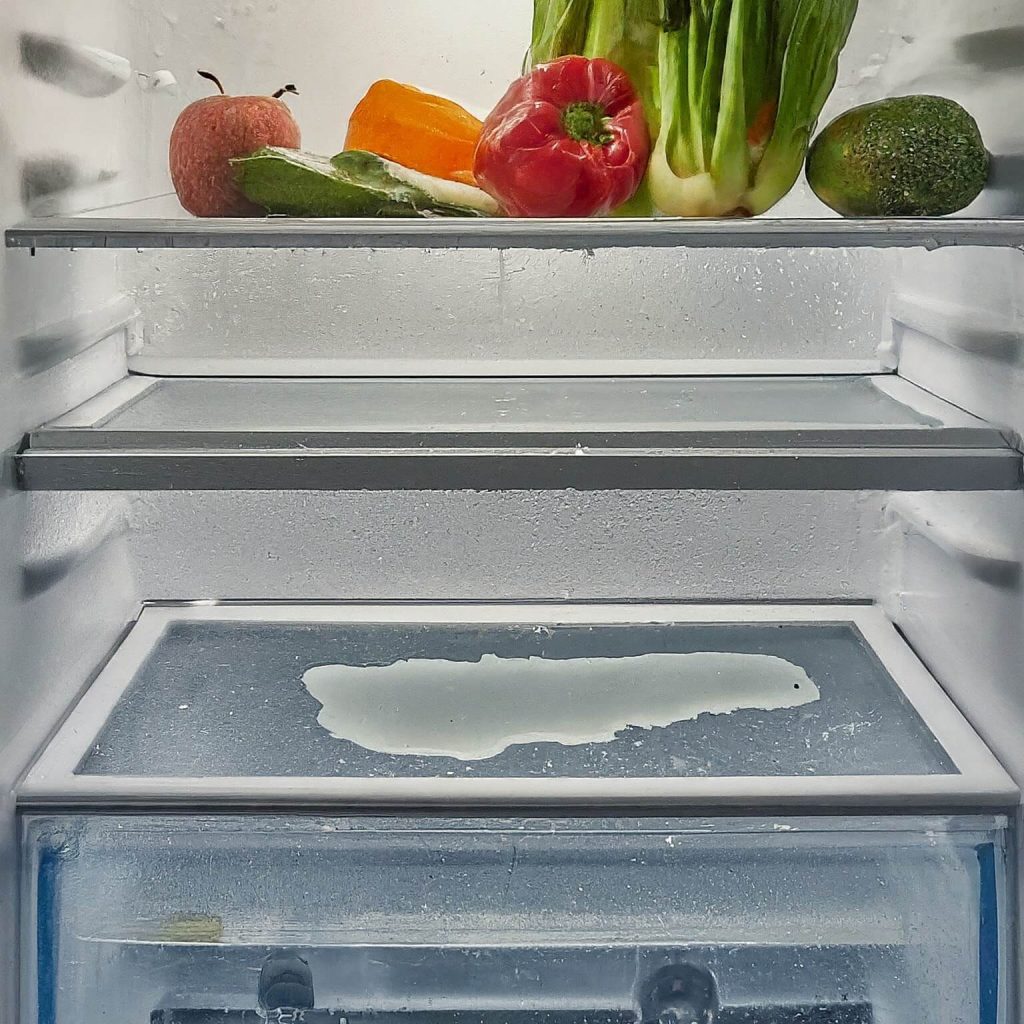

2. Leaking Water

A puddle around your refrigerator can be a real cause for concern. Fortunately, leaky refrigerators are often caused by relatively common issues and can be addressed through troubleshooting or repairs.

Here’s a breakdown of the reasons behind a leaky refrigerator and steps you can take to identify and fix the culprit.

Probable Causes For Refrigerator Leaking Water

- Blocked Drain Line: A clogged drain line caused by food particles or ice buildup can prevent condensation from draining properly, leading to water leakage within the refrigerator compartment.

- Defrost Drain Clog: The defrost drain, located behind the evaporator coils in the freezer section, can become clogged with ice or debris, causing meltwater to overflow and leak into the fresh food compartment.

- Faulty Door Seal: A worn, torn, or improperly fitted door seal allows cold air to escape and warm, humid air to enter the refrigerator. This condensation can then form droplets and leak from the bottom of the refrigerator door.

- Icemaker Malfunction: A faulty icemaker can malfunction and overflow, causing water leakage within the freezer compartment.

Troubleshooting Tips

- Drain Line & Defrost Drain: Locate the drain line and carefully clear any clogs with a long, thin object like a pipe cleaner. For the defrost drain, defrost the refrigerator thoroughly to melt any ice blockage.

- Door Seal: Inspect the door seal for signs of wear or damage. A properly functioning seal should be pliable and form a tight closure with the refrigerator cabinet. Replace the seal if it’s cracked, torn, or doesn’t close firmly.

- Icemaker: If the icemaker is overflowing or leaking, consult your user manual for troubleshooting steps specific to your model. You might need to reset the icemaker, adjust settings, or replace it if it’s malfunctioning beyond repair.

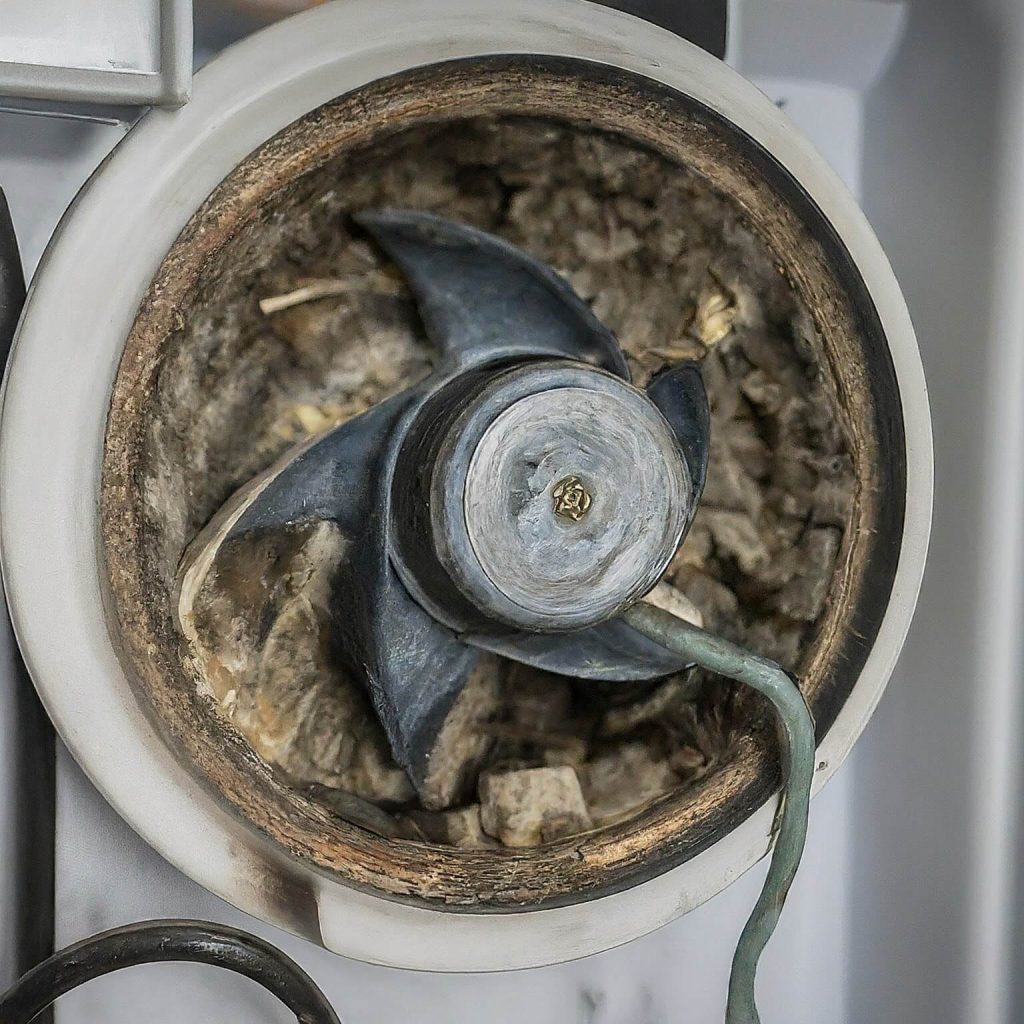

3. Excessive Noise

A quiet refrigerator is a blissful hum in the background symphony of your kitchen. But it can be a sign of trouble when that hum morphs into a grinding, clanging, or buzzing cacophony.

Let’s delve into the causes of excessive noise in refrigerators and explore solutions to restore peace to your kitchen.

Probable Causes For Refrigerators Creating Excessive Noise

- Fan Issues: A noisy condenser or evaporator fan could indicate bearing wear or debris obstructing the blades.

- Compressor Problems: A failing compressor, the heart of the cooling system, can produce louder-than-normal humming or grinding noises.

- Improper Leveling: An unevenly leveled refrigerator can cause vibrations and rattling noises during operation.

Troubleshooting Tips

- Fan Noise: Unplug the refrigerator and carefully clean the condenser fan blades and surrounding area to remove debris. The fan motor might need professional repair or replacement if the noise persists.

- Compressor Noise: A noisy compressor usually signifies a more serious issue. Consult a qualified appliance repair technician to diagnose the problem and determine if repair or replacement is necessary.

- Leveling: Ensure the refrigerator is level by adjusting the leveling feet at the bottom front of the appliance. Consult your user manual for specific instructions on adjusting the leveling feet for your model.

4. Light Bulb Burnout

A burned-out light bulb in a refrigerator isn’t a technical issue related to the cooling cycle. It’s a simple electrical component failure.

Here’s a breakdown of why a refrigerator light bulb might burn out and how to troubleshoot it.

Probable Causes For Light Bulb-Burnouts In Refrigerators

- Incandescent Bulb Filament Rupture: Most refrigerator bulbs are traditional incandescent bulbs. These bulbs have a thin tungsten filament that glows white hot when electricity passes through it. Over time, the filament can weaken and eventually break due to the repeated heating and cooling cycles it experiences when the light is turned on and off.

- Voltage Fluctuations: Sudden spikes or dips in voltage can stress the bulb’s filament, accelerating its deterioration and leading to premature burnout.

Troubleshooting Tips

Replacing a burned-out refrigerator light bulb is a straightforward process. Here’s how:

- Unplug The Refrigerator: Always unplug your refrigerator before attempting any maintenance or repairs, including replacing the light bulb.

- Locate The Bulb: The light bulb is typically located within the upper compartment of the refrigerator, behind a cover or diffuser. Consult your user manual for your refrigerator model’s location and removal instructions. Some models might have a light bulb cover that simply snaps on and off, while others might require unscrewing a small panel to access the bulb.

- Identify Bulb Type: Once you access the bulb, note its size, shape, and base type (e.g., screw-in base). This information will help you purchase the correct replacement bulb. Refrigerator bulbs are typically small appliance bulbs with a low wattage (around 25-40 watts) and a specific base type, so ensure you get a compatible replacement.

Homeowners’ Guide to Refrigerator Longevity: Simple Steps for Lasting Performance

Your refrigerator is a workhorse in the kitchen, silently toiling away to keep your food fresh and safe. But like any appliance, it requires some TLC to function optimally and reach its full lifespan.

Here are some key steps homeowners can take to maximize the life of their refrigerators:

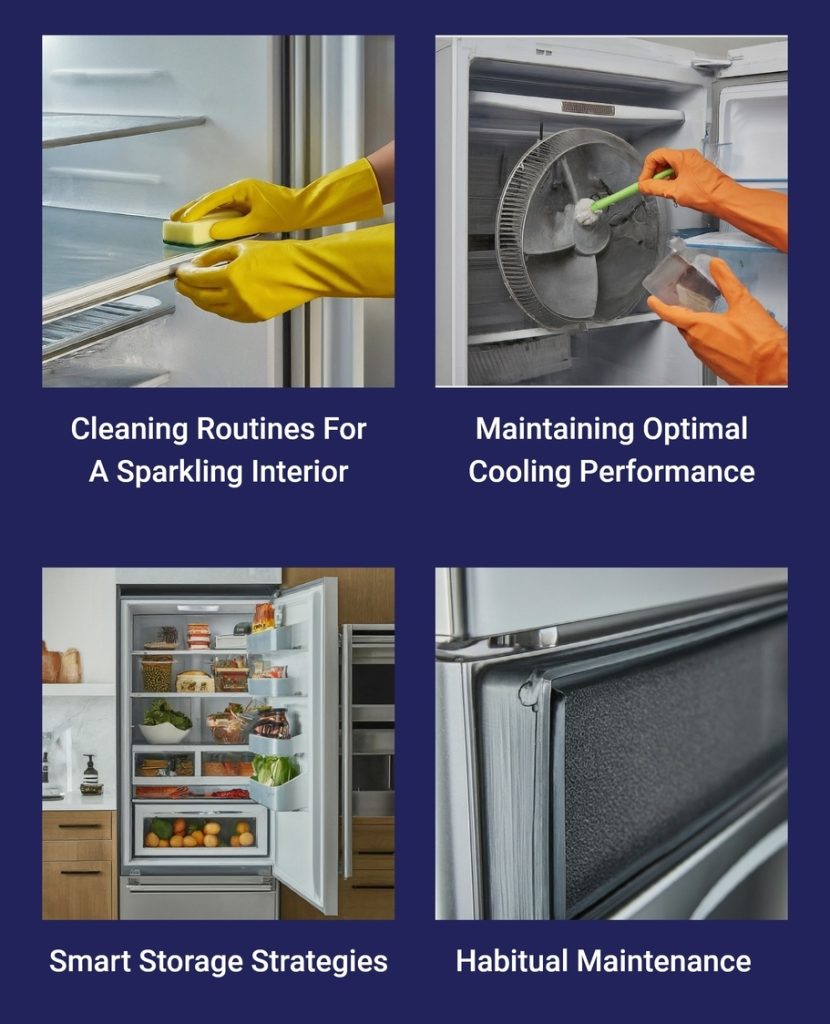

1.Cleaning Routines For A Sparkling Interior

- Regular Wipe Downs: Spills and crumbs are inevitable, but don’t let them fester. Regularly wipe down the interior shelves and drawers with a damp cloth and a mild cleaning solution (like a mixture of water and baking soda). This prevents the growth of bacteria and eliminates odors.

- Deep Cleaning Dives: Dedicate once a month to a more thorough cleaning. Remove all shelves and drawers and wash them with warm, soapy water. Wipe down the interior walls with baking soda, paying attention to corners and crevices where crumbs might hide. Clean the door gasket with warm water and a mild soap to maintain a tight seal.

- Defrost Dilemma (For Frost-Free Models): Modern frost-free refrigerators automatically defrost periodically. However, cleaning the defrost drain hole behind the evaporator coils in the freezer compartment is still a good idea every few months. Use a long, thin object like a pipe cleaner to remove any accumulated debris impeding proper drainage.

2. Maintaining Optimal Cooling Performance

- Coil Care Counts: The condenser coils at the back of the refrigerator release heat. Dust and grime buildup on these coils can significantly reduce their efficiency. Clean them at least twice a year with a vacuum cleaner attachment.

- Airflow for Efficiency: Blocked air vents within the refrigerator and a dirty condenser fan can disrupt cold air circulation, forcing the compressor to work harder. Regularly remove any food items blocking the vents inside the refrigerator. Additionally, clean the condenser fan blades to ensure proper airflow.

3. Smart Storage Strategies

- Don’t Overload: A crammed refrigerator restricts air circulation and puts undue strain on the cooling system. Aim for about 75% capacity, allowing space between items for optimal airflow.

- Strategic Placement: Store hot or warm food items only after they have cooled down completely. Placing hot items inside the refrigerator forces the compressor to work harder to maintain the desired temperature.

- Room Temperature Tango: Avoid placing your refrigerator in direct sunlight or near heat sources like ovens or stoves. This can make the compressor work overtime to maintain a cool temperature.

4. Habitual Maintenance

- Door Gasket Defense: The door gasket is a crucial seal that keeps cold air in and warm air out. Regularly inspect the gasket for cracks, tears, or worn-out areas. A damaged gasket can reduce efficiency and lead to higher energy bills. Replace the gasket if you find any signs of wear and tear.

- Level Up For Stability: An unevenly leveled refrigerator can vibrate excessively during operation, straining internal components and potentially causing noise. Use a level to check if your refrigerator is level. If not, adjust the leveling feet at the bottom front of the appliance to achieve a stable position.

When Should You Call A Professional For Maintenance?

Whether you need a professional for refrigerator maintenance depends on the specific task and your comfort level. Here’s a breakdown to help you decide:

1. DIY-Friendly Tasks

- Cleaning: Most cleaning tasks, wiping down the interior, cleaning shelves and drawers, and vacuuming the condenser coils, can be done by homeowners with basic cleaning supplies.

- Defrost Drain Cleaning (Frost-Free Models): Clearing the defrost drain hole in a frost-free refrigerator is a relatively simple procedure that most homeowners can tackle using a pipe cleaner or a turkey baster.

- Leveling the Refrigerator: Adjusting the leveling feet at the bottom of the refrigerator to achieve a stable position is a straightforward task that requires a level and a wrench.

2. Consider Calling a Professional

- Replacing the Door Gasket: While some homeowners might be comfortable replacing a worn-out door gasket, the process can be tricky on certain models. Professionals have the experience and expertise to ensure a proper seal is achieved.

- Fan Motor Issues: Diagnosing and replacing a faulty condenser fan motor or evaporator fan motor might require some electrical knowledge and tools. If you’re uncomfortable with electrical work, it’s best to call a qualified appliance repair technician.

- Compressor Problems: The compressor is vital to the refrigerator’s cooling system. Leave it to the professionals if you suspect a compressor issue, such as excessive noise or inadequate cooling. Repairing or replacing a compressor can be complex and might involve refrigerant handling, which requires a licensed technician.

How Does A Home Warranty Protect Your Refrigerator?

A home warranty can provide valuable protection for your refrigerator in case of unexpected breakdowns. Here’s how home warranty coverage typically works for refrigerators:

- Coverage For Repairs: Most home warranty plans cover repairs for major refrigerator components in case of malfunction. This could include issues like:

- Faulty Compressor: The compressor is the heart of the cooling system. If it malfunctions, a home warranty might cover repairs or replacements.

- Defrost System Problems: A home warranty can cover issues like a defective defrost timer, heater, or temperature sensor that prevents proper defrosting.

- Refrigerant Leaks: While some plans might exclude refrigerant leaks, depending on the specific plan details, some warranties might cover the cost of leak repair and refrigerant recharge.

- Evaporator Or Condenser Fan Issues: A malfunctioning evaporator or condenser fan can disrupt air circulation and cooling performance. Home warranty coverage might extend to repairs or replacements for these fan motors.

- Financial Protection: Refrigerator repairs can be expensive, especially when replacing major components. A home warranty helps you avoid these hefty upfront costs.

Conclusion

In conclusion, maintaining your refrigerator doesn't require a degree in appliance engineering. By incorporating these simple yet effective tips into your routine, you can ensure your refrigerator keeps your food fresh and functions optimally for years.

Regular cleaning, maintaining proper airflow, and strategic storage practices maximize efficiency and lifespan. Remember, a little effort on your part translates to a happy and healthy refrigerator, saving you money on repairs and replacements down the line.

Don't hesitate to consult a qualified appliance repair technician for trickier tasks or situations where you're unsure. Their expertise can diagnose problems accurately and ensure your refrigerator is back in shape quickly and safely.

related articles

Discover First American Home Warranty Locations and What You Need to Know About Their Cover.

Discover First American Home Warranty Locations and What You Need to Know About Their Cover.

Reviews of Home Warranty Companies Show You How to Determine If Your Home Is Covered

Reviews of Home Warranty Companies Show You How to Determine If Your Home Is Covered