Last updated: July 30th, 2024

Last updated: July 30th, 2024

Homeowner's Guide To Structural Warranties for New Homes

Congratulations on your new home! Understanding the intricacies of your home’s warranty is crucial as you settle in. This guide delves into the specifics of structural warranties, ensuring you’re well-informed about their protections.

What Is A Structural Warranty?

By understanding your structural warranty and its limitations, you can ensure your new home is protected against unforeseen structural issues. Don’t hesitate to contact your builder or warranty provider with questions or concerns. With clear communication and a proactive approach, you can enjoy peace of mind in your structurally sound and secure new home.

In essence, a structural warranty is an insurance policy specifically designed to safeguard against unforeseen defects that compromise the structural integrity of your new home. It’s a written agreement established between the builder/developer and the homeowner, outlining the builder’s obligations regarding the construction quality and durability of the key structural components.

What Does A Structural Warranty Typically Cover?

When you purchase a new home, a structural warranty protects against unforeseen problems that threaten the very foundation of your investment. This comprehensive guide delves into the specifics of structural warranty coverage, ensuring you understand its protections.

Here are the key areas typically covered:

- Major Structural Defects: Significant problems directly affect the home’s ability to support itself and withstand weight. Examples include:

- Foundation Failure: Cracks in the foundation walls or floors, uneven settlement of the foundation, or issues with the crawlspace that threaten the structural stability of the home.

- Roof Collapse: Failure of the roof structure due to faulty construction, weight overload, or material defects.

- Severe Wall Cracks: Extensive cracks that run diagonally across walls, indicating potential foundation or structural issues.

- Material Defects: The warranty might cover problems arising from flaws in the materials used for critical structural components. This could include:

- Concrete: Issues with the concrete mix, improper curing, or cracks that compromise the foundation’s strength.

- Framing Lumber: Lumber that’s warped, cracked, or not pressure-treated as specified, leading to structural weaknesses.

- Roofing Materials: Defects in roofing shingles, underlayment, or flashing that allow water infiltration and potentially cause structural damage.

- Workmanship Errors: In some cases, builders’ construction mistakes can lead to structural problems. A well-defined structural warranty should cover repairs to rectify these errors, such as:

- Improper installation of load-bearing walls or beams.

- Faulty connections between structural components.

- Errors in framing techniques that compromise the building’s integrity.

Understanding Warranty Exclusions

Warranties are often advertised as a safety net, protecting you from unexpected repair costs. However, it’s crucial to understand that no warranty covers everything. This detailed note explores the concept of warranty exclusions and equips you to navigate the fine print confidently.

What are Warranty Exclusions?

Warranty exclusions are specifically outlined clauses within a warranty agreement that exempts the manufacturer or service provider from covering certain repairs or replacements. In essence, they define the boundaries of the warranty’s coverage.

Why Do Warranties Have Exclusions?

There are several reasons why warranties exclude certain situations:

- Normal Wear & Tear: Warranties aren’t designed to cover the inevitable effects of everyday use. Imagine a shoe warranty not covering worn-out soles – that’s the basic idea. Examples of excluded wear and tear include:

- Faded paint due to sun exposure

- Worn-out appliance belts or filters

- Scratches on a device screen caused by normal use

- Misuse & Abuse: Warranties typically don’t cover improper use or neglect damage. This could include:

- Using a power tool for a purpose beyond its intended design

- Failing to follow proper maintenance procedures outlined in the user manual

- Physical damage caused by dropping or mishandling a device

- Pre-Existing Conditions: Most warranties won’t cover issues that existed before the product was purchased, even if they weren’t immediately apparent.

- Acts Of God: Events beyond human control, such as natural disasters or power surges, are often excluded from warranty coverage.

- Unauthorized Repairs: The warranty might be voided if you attempt to repair the product or use unauthorized repair services.

How to Find Warranty Exclusions

Warranty exclusions are typically outlined in a separate section of the warranty document (often titled “Exclusions” or “Limitations”). They might also be phrased in legalese, so careful reading is essential.

Here are some tips for finding warranty exclusions:

- Read The Warranty Document Thoroughly: Don’t just skim the warranty. Take the time to understand all the terms and conditions, especially the exclusions section.

- Look for Key Phrases: Be mindful of phrases like “normal wear and tear,” “misuse,” “unauthorized repairs,” or “acts of God.” These often indicate exclusions.

- Don’t Hesitate To Ask Questions: If you’re unsure about any aspect of the warranty exclusions, don’t hesitate to contact the manufacturer or seller for clarification.

The Importance of Understanding Exclusions

Knowing what your warranty doesn’t cover empowers you to make informed decisions. Here’s why understanding exclusions is important:

- Avoids Unexpected Costs: By being aware of exclusions, you can avoid the disappointment of a warranty claim denial and potentially significant repair costs.

- Helps Manage Expectations: A realistic understanding of warranty coverage helps you set proper expectations for the product’s lifespan and potential repair needs.

- Promotes Proper Use: Knowing what actions could void your warranty can encourage you to carefully handle the product and follow recommended maintenance practices.

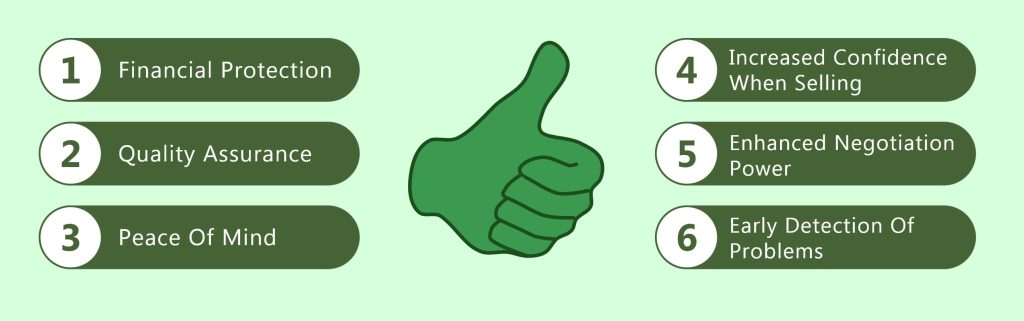

The Benefits Of Structural Warranties For New Homes

Purchasing a new home is a significant investment. A structural warranty protects you from unforeseen structural issues that could threaten the very foundation of your dream home. But what exactly are the benefits of having a structural warranty? Let’s delve into the advantages it offers to new homeowners:

- Financial Protection: Major structural defects can be costly to repair. A structural warranty provides financial security by covering the repair costs associated with these issues. This can prevent a significant financial burden from falling on the homeowner.

- Quality Assurance: The existence of a structural warranty incentivizes builders to use high-quality materials and adhere to proper construction practices. Knowing they’ll be held accountable for structural problems encourages builders to prioritize quality construction.

- Peace Of Mind: A well-defined structural warranty offers invaluable peace of mind for new homeowners. It allows you to settle into your new home with the confidence that major structural issues are covered, reducing worries about potential hidden problems.

- Increased Confidence When Selling: When it comes time to sell your new home, a transferable structural warranty can be a selling point. It demonstrates the quality of the construction and provides potential buyers with added confidence in the home’s structural integrity.

- Enhanced Negotiation Power: During the home buying process, understanding the details of the structural warranty can empower you during negotiations with the builder. You can ensure the warranty terms are comprehensive and address your specific concerns.

- Early Detection Of Problems: Structural warranties often encourage regular inspections by qualified professionals. These inspections can identify potential issues early on, allowing for timely repairs and preventing minor problems from escalating into major structural defects.

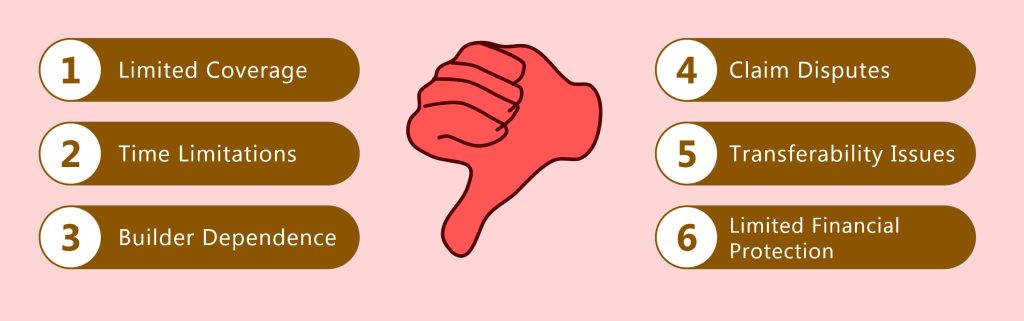

Demerits of Structural Warranties for New Homes

While structural warranties offer valuable protection for new homeowners, they aren’t without limitations. Here’s a closer look at some potential drawbacks to consider:

- Limited Coverage: Structural warranties focus primarily on major structural defects. They don’t cover minor issues like settling cracks, cosmetic blemishes, or problems arising from everyday use.

- Time Limitations: The coverage period for structural warranties is typically 10 years, but the most comprehensive protection might only apply during the initial few years. After that, the warranty provider’s responsibility for repairs might be more limited.

- Builder Dependence: In the initial years, the builder is often responsible for repairs under the warranty. If the builder leaves business during this period, enforcing the warranty and securing repairs could become challenging.

- Claim Disputes: Defining a “structural defect” can be subjective. Disagreements between homeowners and warranty providers regarding coverage and repairs are not uncommon. Resolving such disputes might require involving a professional engineer or legal recourse.

- Transferability Issues: Structural warranties might not always be transferable to subsequent homeowners if you sell the property before the warranty expires. It’s crucial to check the specific terms of your warranty regarding transferability.

- Limited Financial Protection: While structural warranties cover repairs, they typically don’t cover living expenses incurred if

Demystifying Home Protection: Structural Warranties vs. Home Warranties and Insurance

When it comes to safeguarding your new home, various terms like “structural warranties,” “home warranties,” and “home insurance” get thrown around. Understanding these distinctions is crucial to ensure your home is comprehensively protected. Here’s a breakdown to help you navigate these different types of coverage:

Structural Warranties

- Focus: Structural warranties protect against major defects that compromise the structural integrity of your new home.

- Coverage: They typically cover issues like foundation failures, roof collapses, or severe wall cracks threatening the building’s stability.

- Duration: Structural warranties generally last ten years, often divided into phases with specific coverage details for each.

- Responsibility: The builder or developer is typically responsible for repairs covered under the structural warranty during the initial years. Later, a designated warranty provider might take over the responsibility.

- Cost: Structural warranties are usually included in the purchase price of a new home from a builder.

Home Warranties

- Focus: Home warranties are optional service contracts purchased by homeowners to cover repairing or replacing appliances and major home systems due to normal wear and tear.

- Coverage: Specific coverage details vary depending on the plan chosen, but commonly covered items include major appliances (refrigerators, dishwashers, ovens), plumbing components (water heaters, garbage disposals), and electrical systems (wiring, circuit breakers).

- Duration: Home warranty contracts typically last one year, with annual renewal options.

- Responsibility: In the event of a covered appliance or system breakdown, the homeowner contacts the home warranty company, who then arranges for a qualified repair person to diagnose and fix the issue.

- Cost: Home warranty plans come with an annual or monthly premium the homeowner pays.

Home Insurance

- Focus: Home insurance protects your home and its contents from damage caused by unforeseen events. These events typically include fire, theft, vandalism, weather events (wind, hail, etc.), and certain types of water damage.

- Coverage: Specific coverage details vary depending on the policy chosen, but standard policies cover the dwelling structure, personal belongings, and potential liability if someone gets injured on your property.

- Duration: Home insurance policies typically last for one year, with the option to renew annually.

- Requirement: Homeowners with a mortgage typically are required to have home insurance by their lender.

- Cost: Home insurance premiums are calculated based on various factors, such as location, dwelling value, and coverage options chosen.

Key Differences

Here’s a table summarizing the key differences between these three types of coverage:

|

Feature |

Structural Warranty |

Home Warranty |

Home Insurance |

|

Focus |

Structural integrity |

Appliances & Systems |

Dwelling & Contents |

|

Coverage Examples |

Foundation failure, roof collapse |

Dishwasher breakdown, AC failure |

Fire, theft, wind damage |

|

Duration |

10 years (phased) |

1 year (renewable) |

1 year (renewable) |

|

Responsibility |

Builder/Warranty Provider |

Home Warranty Company |

Insurance Company |

|

Cost |

Included in purchase price (usually) |

Optional – Annual/Monthly premium |

Mandatory for mortgages (usually) |

Conclusion: Building a Secure Future with Structural Warranties

A new home signifies a fresh start, a place to build dreams and memories. Understanding structural warranties empowers you to safeguard this investment from the foundation up. This guide has equipped you with the knowledge to navigate the intricacies of structural warranties, understand their coverage, and recognize their limitations.

Remember, a structural warranty is a valuable tool, but it's just one piece of the puzzle. By familiarizing yourself with the warranty details, asking questions, and exploring additional protection options, you can create a comprehensive safety net for your new home.

With this knowledge and proactive approach, you can confidently embark on this new chapter, knowing your haven is well-protected for years to come. So, breathe easy, unpack the boxes, and enjoy the peace of mind of a structurally sound and secure new home.

related articles

Discover First American Home Warranty Locations and What You Need to Know About Their Cover.

Discover First American Home Warranty Locations and What You Need to Know About Their Cover.

Reviews of Home Warranty Companies Show You How to Determine If Your Home Is Covered

Reviews of Home Warranty Companies Show You How to Determine If Your Home Is Covered