Last updated: August 7th, 2024

Last updated: August 7th, 2024

Home Warranty 101: How Does A Home Warranty Work And What Should You Know About Them

As a homeowner, you know the joy of your space and the responsibility of maintaining it. Unexpected breakdowns of appliances and home systems can be a major headache and financial strain. This is where home warranties come in – they offer a safety net to help you weather these storms.

But are home warranties right for you? In this comprehensive guide, we’ll break down how home warranties work in the US, what to consider when choosing a plan, and the pros and cons to help you decide if a home warranty is a wise investment for your home.

Demystifying the Process: How Does a Home Warranty Work?

US home warranties function like a safety net for your essential home systems and appliances.

Here’s a breakdown of the typical process:

1. Choosing Your Plan

- Shop Around: Research different home warranty companies and compare plans.

- Coverage Matters: Carefully review what appliances and systems are covered (e.g., plumbing, electrical, major appliances like refrigerators and ovens).

- Limits & Costs: Understand coverage limits for repairs or replacements and any applicable deductibles (the amount you pay before the warranty kicks in).

2. Securing Your Coverage

- Enrollment Is Easy: Once you’ve chosen a plan, enroll with the warranty company and pay your monthly or annual premium.

- Pre-existing Condition Check: Be upfront about any pre-existing conditions in your appliances or systems, as the warranty might not cover these.

- Waiting Period Woes: Some warranties have a waiting period (typically 30 days) before coverage kicks in. Be mindful of this timeframe when choosing a plan.

- Renewals & Cancellations: Review the renewal terms and cancellation policy before enrolling.

3. When the Unexpected Strikes

- File A Claim: If a covered appliance or system malfunctions, contact your warranty company to file a claim. This can usually be done by phone or online.

- Dispatching The Cavalry: The warranty company will send a qualified technician from their network to diagnose the problem.

4. Repair or Replacement

- Repair Efforts: Depending on the issue and coverage limits, the technician will attempt to repair the appliance or system using genuine parts.

- Replacement Potential: If repairs are not possible or cost-prohibitive, the warranty company may replace the covered item (up to the coverage limit).

5. The Cost Factor

- Service Call Fees: Be prepared for a service call fee each time a technician visits, even if they can’t fix the problem on the spot. This fee is typically outlined in your plan details.

- Coverage Limits Reminder: Remember, the warranty company will only cover repairs or replacements up to a set limit outlined in your plan. You’ll be responsible for any costs exceeding that limit.

Essential Knowledge: What You Should Know About Home Warranties

Home warranties in the US can be a valuable tool for homeowners, but it’s crucial to approach them.

Here’s a breakdown of key things to consider:

1. Understanding Coverage

- Read The Fine Print: This is paramount. Carefully examine the plan details to understand exactly what’s covered (appliances, systems, exclusions). Be bold and ask the warranty company questions if anything needs clarification.

- Beware Of Exclusions: Be aware of exclusions like pre-existing conditions, specific appliance brands, cosmetic damage, or improper maintenance-related breakdowns.

- Limits & Deductibles: Coverage limits dictate the maximum amount the warranty company will pay for a repair or replacement. Deductibles are similar to what you might pay with car insurance; you’ll be responsible for this amount before the warranty coverage kicks in.

2. The Contractor Network

- Quality Matters: The warranty company selects the technicians who repair your appliances and systems. Research the company’s reputation for quality work and customer service to ensure they have a network of qualified and reliable technicians in your area.

- Choice Of Technician: While the warranty company selects the technician, some plans allow you to request a different one if needed.

3. Customer Support

- Responsiveness Is Key: Ensure the warranty company has a responsive customer support team to address your inquiries and claims efficiently. You can easily reach someone to file a claim and start the repair process quickly in a breakdown.

- Claim Process Clarity: Understand the claim filing process outlined by the warranty company. This typically involves contacting them, providing details about the issue, and potentially submitting photos or documentation.

4. Additional Considerations

- Age Of Your Home’s Warriors: As appliances and systems age, the likelihood of breakdowns increases. If your home has older components, a home warranty can provide peace of mind, knowing you’re protected from high repair costs.

- Budget For Unexpected Repairs: If unexpected repair bills strain your budget, a home warranty can help you spread out the cost of repairs over time with predictable monthly premiums.

- DIY Skills & Comfort Level: If you’re comfortable diagnosing and fixing appliance and system issues, you might not need a home warranty. However, a home warranty can be a convenient option if you’d prefer to call in a professional for repairs.

Who Should Consider Getting a Home Warranty?

A home warranty can be a valuable asset for several types of homeowners:

- New Homeowners: If you’re a new homeowner, you might inherit appliances and systems of unknown age and condition. A home warranty can provide peace of mind during the initial years of ownership, potentially covering unexpected breakdowns that arise from normal wear and tear.

- Homeowners With Older Appliances And Systems: As appliances and systems age, the likelihood of breakdowns increases. A home warranty can be a financial shield against the potentially high costs of repairs or replacements for these older components.

- Budget-conscious folks: If unexpected repair bills derail your finances, a home warranty can help you budget for homeownership costs more predictably. The set monthly or annual premium can be easier to manage than potentially large, unexpected repair costs.

- Those Who Value Convenience: A home warranty offers convenience if you prefer to have a professional handle repair rather than tackling them yourself. The warranty company will hire a qualified technician to diagnose and fix the issue.

Who Might Not Need a Home Warranty?

While home warranties offer benefits, they might not be suitable for everyone. Here’s a breakdown of who might consider skipping a home warranty:

- DIY Masters: If you’re a handy homeowner who enjoys diagnosing and fixing appliance and system issues yourself, a home warranty might not be necessary. You’ll save on the monthly or annual premium and be satisfied with tackling repairs.

- New Appliance Owners: If your appliances are brand new and have comprehensive manufacturer warranties, you might not need additional coverage for a few years. Manufacturer warranties typically cover breakdowns due to defects in materials or workmanship.

- Those With A Healthy Repair Fund: If you have a dedicated fund specifically earmarked for home repairs, you might be comfortable self-insuring against potential breakdowns. A readily available pool of money can help you manage unexpected repair costs without a warranty.

Key Suggestions To Homeowners Looking To Get Home Warranty Plans

Here are some key things customers should know while getting a home warranty in the US:

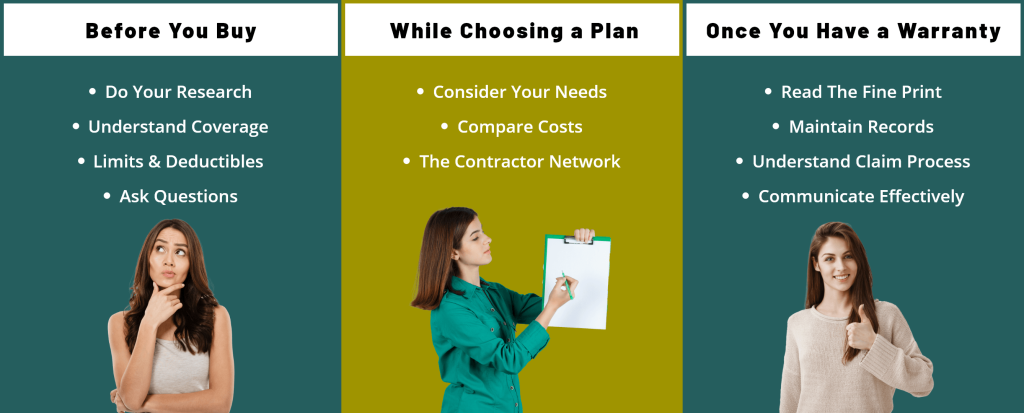

1. Before You Buy

- Do Your Research: Don’t just jump on the first offer you see. Research different home warranty companies, read reviews, and compare plans.

- Understand Coverage: Carefully examine the plan details to grasp what appliances and systems are covered (and what’s excluded). Pay close attention to exclusions for pre-existing conditions, specific brands, cosmetic damage, or breakdowns due to improper maintenance.

- Limits & Deductibles: Be aware of coverage limits (the maximum amount the warranty company will pay for a repair or replacement) and any applicable deductibles (the amount you’ll pay before the warranty coverage kicks in).

- Ask Questions: Don’t hesitate to ask the warranty company questions to clarify any uncertainties you might have about plan details, claim processes, or service call fees.

2. While Choosing a Plan

- Consider Your Needs: Analyze your specific needs as a homeowner. Think about the age and condition of your appliances and systems, your repair budget, and your DIY comfort level.

- Compare Costs: Compare the monthly or annual premiums of different plans alongside their coverage details and service call fees. Don’t always assume the cheapest option is the best; a slightly higher premium might offer more comprehensive coverage.

- The Contractor Network: Investigate the warranty company’s reputation for quality customer service and the technicians’ qualifications in their network.

3. Once You Have a Warranty

- Read The Fine Print: Thoroughly review the warranty contract you receive. This document outlines all the details of your coverage, including exclusions, claim procedures, and dispute resolution mechanisms.

- Maintain Records: Keep detailed records of your home warranty contract, appliance manuals, and maintenance documentation. This will be helpful if you need to file a claim.

- Understand Claim Process: Familiarize yourself with the claim filing process outlined by your warranty company. This typically involves contacting them, providing details about the issue, and potentially submitting photos or documentation.

- Communicate Effectively: Maintain clear communication with the warranty company throughout the repair process. If you have any questions or concerns, don’t hesitate to contact their customer support team.

Conclusion

Now that you've explored the ins and outs of home warranties in the US, you're well-equipped to make an informed decision. Remember, a home warranty can be valuable, offering peace of mind and financial protection against unexpected appliance and system breakdowns.

However, it's not a one-size-fits-all solution. By carefully considering your unique needs, budget, and comfort level with repairs, you can determine if a home warranty is the right investment for your homeownership journey.

related articles

Discover First American Home Warranty Locations and What You Need to Know About Their Cover.

Discover First American Home Warranty Locations and What You Need to Know About Their Cover.

Reviews of Home Warranty Companies Show You How to Determine If Your Home Is Covered

Reviews of Home Warranty Companies Show You How to Determine If Your Home Is Covered