Last updated: August 7th, 2024

Last updated: August 7th, 2024

The Ultimate HVAC Maintenance Guide for Homeowners: Keeping Your Comfort In Control

Your HVAC system is the silent warrior of your home, tirelessly maintaining your desired temperature and air quality. But like any warrior, it requires regular maintenance to function optimally. This comprehensive guide empowers you, the homeowner, with the knowledge to perform essential HVAC maintenance tasks and troubleshoot minor issues, ensuring your comfort and avoiding costly repairs.

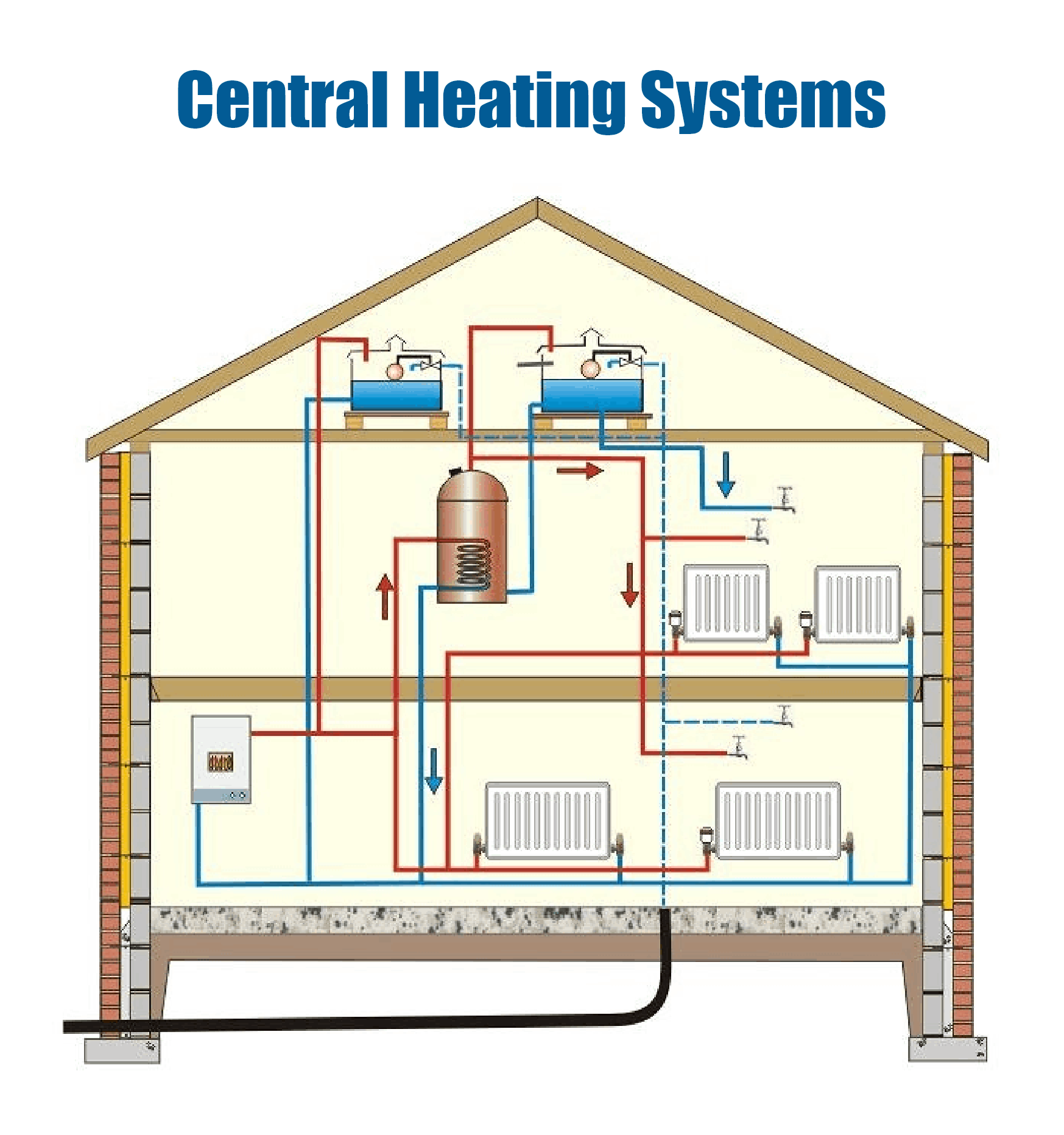

Understanding Your HVAC System

Here’s a deeper dive into the functions and maintenance considerations for these crucial HVAC system components:

|

Parts |

Function |

Maintenance Frequency |

Action |

|

Air Filter |

A disposable or reusable filter that captures dust, allergens, and other airborne particles from the air circulating through the system. |

Replace monthly for high-efficiency filters, every 2-3 months for standard filters. |

Remove the old filter and replace it with a new one of the same size. Ensure the filter is inserted with the correct airflow direction. |

|

Furnace/Boiler |

Heats the air in your home, typically powered by gas, oil, or electricity. |

Annual professional maintenance |

Regular air filter changes are crucial for optimal furnace operation. A clogged filter restricts airflow, reducing efficiency and potentially causing the furnace to overheat. |

|

Air Conditioner (AC Unit) |

Cools the air in your home, powered by electricity. |

Quarterly cleaning. |

Turn off the power to the AC unit. Carefully remove leaves, twigs, and debris from around the unit. To remove dust buildup, you can carefully hose down the fins (avoid bending them). |

|

Thermostat |

The control center of your HVAC system regulates temperature by sending signals to the furnace and AC unit. |

Monthly cleaning. |

Turn off the thermostat’s power and gently wipe it down with a soft, damp cloth to remove dust and debris. |

|

Ductwork |

A network of insulated metal pipes that distribute conditioned air throughout your home. |

As needed (during cleaning) |

Ensure ductwork is properly insulated, especially in unconditioned spaces like attics or crawlspaces. Proper insulation prevents conditioned air loss and improves overall system efficiency. |

|

Vents/Registers |

Openings in walls or floors that allow conditioned air to enter and exit rooms. |

As needed (during cleaning) |

Vacuum dust and debris from the vents and registers to ensure proper airflow. |

|

Condensation Line |

A drain line that removes moisture collected during the cooling process from the AC unit. |

Quarterly cleaning. |

Consult your user manual to locate the drain line cleanout. Use a wet/dry vacuum or a plumber’s snake to remove any clogs. |

|

Blower Fan |

A fan that circulates air through the system and across the heat exchanger (furnace) or evaporator coil (AC unit). |

Annual professional maintenance |

Regular air filter changes are essential for optimal blower fan performance. A clogged filter restricts airflow, making the blower fan work harder and potentially leading to premature motor failure. |

Demystifying Your HVAC System: A Comprehensive Guide To Components And Maintenance

This section dives deeper into the technical aspects of the core HVAC components, empowering you with a more comprehensive understanding:

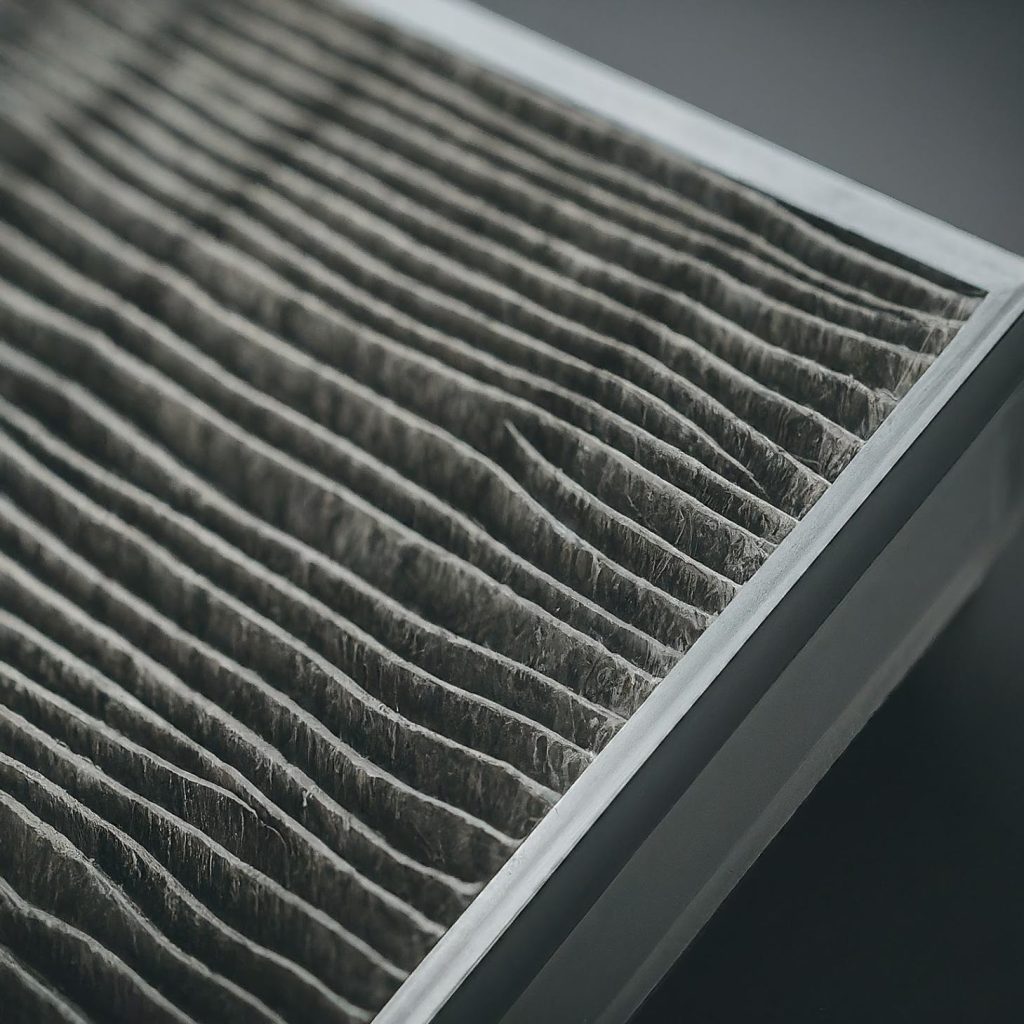

1. Air Filter

The air filter in your HVAC system acts as the first line of defense against airborne contaminants, safeguarding your indoor air quality and the overall health of your system. Understanding the technical aspects of air filter maintenance empowers you to make informed decisions for optimal performance and efficiency.

Air Filter Fundamentals

Air filters capture dust, allergens, pet dander, pollen, smoke, and other airborne particles as air circulates through the HVAC system. This prevents these contaminants from being distributed throughout your home and impacting indoor air quality.

Types Of Air Filters

- Disposable Filters: The most common type, made of pleated paper or fabric and designed for single use. MERV ratings (Minimum Efficiency Reporting Value) indicate filtration efficiency. Higher MERV ratings capture smaller particles but restrict airflow slightly.

- Electrostatic Filters: Reusable filters that utilize static electricity to trap dust and allergens. Require regular cleaning to maintain efficiency.

- HEPA Filters (High-Efficiency Particulate Air): Exceptionally efficient at capturing very small particles, including allergens, bacteria, and viruses. However, they significantly restrict airflow and might not be suitable for all HVAC systems.

Air Filter Maintenance Best Practices

Here are some of the best practices for the maintenance of air filters that can be followed:

- Replacement Frequency:

- Disposable Filters:

- High-efficiency filters (MERV 13-16): Replace monthly.

- Standard filters (MERV 8-12): Replace every 2-3 months.

- Electrostatic Filters: Clean and wash according to the manufacturer’s instructions, typically every few months.

- HEPA Filters: May require replacement every 6-12 months, depending on usage and MERV rating.

- Disposable Filters:

- Placement: Ensure the air filter is inserted correctly with the airflow arrows pointing toward airflow.

- Visual Inspection: Regularly check your air filter for signs of clogging or discoloration. A clogged filter restricts airflow, reduces efficiency, and strains the blower fan motor.

2. Furnace/Boiler

Your furnace or boiler is the silent warrior of winter comfort, battling the cold to keep your home warm. But like any warrior, it requires regular maintenance to function optimally.

Understanding Your Furnace/Boiler

Furnaces and boilers share the same basic function – generating heat for your home. However, they differ in their fuel source and heat transfer methods:

- Furnaces: These use natural gas, propane, or electric resistance heating elements to generate heat. A heat exchanger transfers this heat to the circulating air, distributed through the ductwork.

- Boilers: These use various fuels, such as natural gas, oil, propane, or electricity, to heat water. The hot water is circulated through pipes to radiators or a radiant floor system, releasing heat into your living space.

Essential Maintenance Tasks (Yearly by a Qualified Technician)

Here are some of the important tasks that need to be undertaken for adequate maintenance of the furnace/boiler.

- Combustion Inspection and Cleaning:

- Gas/Oil Furnaces: The technician will inspect the burner assembly for proper combustion. This includes cleaning clogged burners, ensuring proper gas/oil pressure, and verifying adequate air intake for optimal efficiency and safety.

- Electric Furnaces: While electric furnaces don’t require combustion inspection, the technician will check the heating elements for signs of wear and tear.

- Heat Exchanger Inspection: This crucial component transfers heat from the combustion process (gas/oil) or electrical resistance (electric) to the circulating air/water. The technician will visually inspect for cracks, leaks, or signs of deterioration that could compromise efficiency or safety.

- Lubrication: Moving parts like blower fan motors benefit from lubrication to minimize friction, reduce wear and tear, and ensure smooth operation.

- Flue Inspection (Gas/Oil Furnaces Only): The flue vents combustion gasses out of your home. The technician will check for blockages or leaks that could prevent proper venting and pose safety hazards.

- Safety Checks: The technician will verify proper operation of safety features like flame safeguards, pressure switches, and high-limit controls.

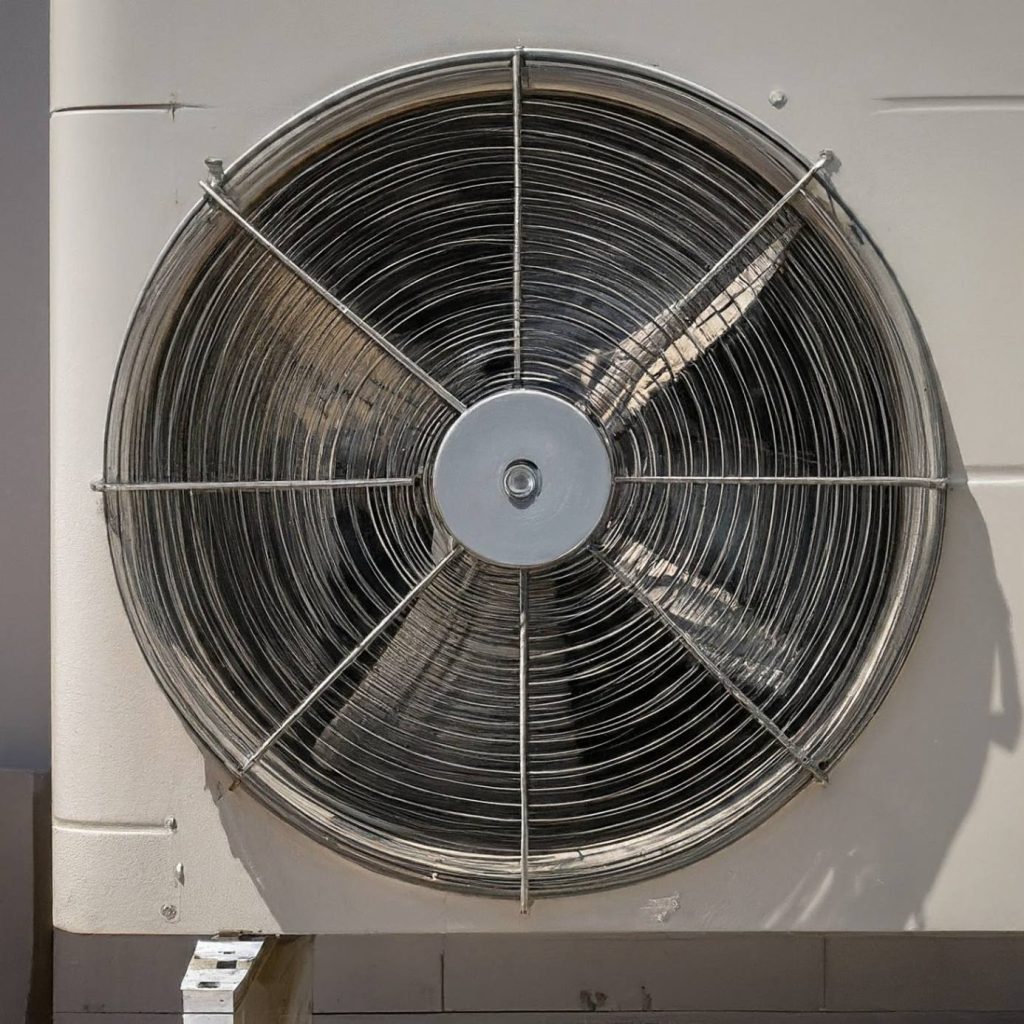

3. Air Conditioner (AC Unit)

The air conditioner (AC unit) is your summer savior. It silently battles the heat and humidity to create a cool and comfortable haven in your home.

Core Components & Functionality

- Compressor: The heart of the system, compressing refrigerant vapor to increase its pressure and temperature.

- Condenser Coil: Located outdoors, this coil releases heat from the indoor air to the surrounding environment.

- Evaporator Coil: Located indoors, the evaporator coil absorbs heat from the indoor air, causing the refrigerant to evaporate.

- Expansion Valve: The expansion valve reduces the refrigerant’s pressure and temperature before it enters the evaporator coil.

- Refrigerant Lines: These lines carry pressurized refrigerant throughout the system.

- Drain Line: Removes condensate (moisture) collected during the cooling process.

- Blower Fan: This circulates air across the evaporator coil for cooling and throughout your home.

Best Practices For AC Unit Maintenance

- Cleaning the Outdoor Unit

- Turn off the power: Safety first! Ensure the AC unit is completely off at the breaker box.

- Clear Debris: Carefully remove leaves, twigs, and debris around the unit.

- Clean the Condenser Coil: Gently hose down the condenser coil fins (avoid bending them) to remove dust buildup. Clean fins allow for efficient heat exchange.

- Air Filter Replacement

-

- Replace the air filter with a new one of the same size and MERV rating (consult your user manual for recommendations). A clean filter ensures optimal airflow and prevents the evaporator coil from clogging.

- Thermostat Cleaning

- Use a soft, damp cloth to wipe down the thermostat to remove dust and debris. This ensures accurate temperature readings and proper system operation.

- System Inspection & Cleaning

- A technician will thoroughly inspect the entire AC unit, including:

- Checking electrical connections for tightness and corrosion.

- Inspecting the compressor for leaks or signs of wear.

- Cleaning the evaporator coil to remove accumulated dirt and debris.

- Verifying proper refrigerant level and pressure (improper levels can reduce efficiency or damage the compressor).

- A technician will thoroughly inspect the entire AC unit, including:

- Drainage System Maintenance

-

- The technician will check for clogs in the condensate drain line and clear them if necessary. A clogged drain can lead to water damage inside your home.

- Other Considerations For Proper Maintenance

- Refrigerant Levels: Maintaining proper refrigerant levels is crucial for optimal performance and efficiency. A qualified technician can check and adjust refrigerant levels if needed. Low refrigerant levels can lead to reduced cooling capacity and compressor strain.

- Frozen Coils: A clogged air filter or dirty evaporator coil can restrict airflow and cause the evaporator coil to freeze. Regular maintenance can help prevent this issue.

- Unusual Noises: Strange noises coming from the AC unit can indicate loose parts, failing bearings, or other problems. Consult a technician if you notice any unusual noises.

- Safety Precautions

-

- Always turn off the AC unit power before performing any maintenance tasks.

- Never attempt to tamper with electrical components or refrigerant lines. Leave these tasks to qualified professionals.

- Be aware of hazards like sharp edges or exposed wiring while cleaning the outdoor unit.

4. Thermostat

The thermostat, often a simple-looking device on your wall, plays a critical role in your HVAC system. It acts as the brain of the operation, constantly monitoring the temperature and sending signals to your furnace and AC unit to maintain your desired comfort level.

Basic Maintenance Of Thermostat

- Cleaning:

- Frequency: Monthly cleaning is recommended.

- Action: Turn off the thermostat’s power at the breaker box. Use a soft, damp cloth to gently wipe down the thermostat’s surface, removing dust, dirt, and cobwebs. Avoid using harsh chemicals or abrasive cleaners that could damage the unit.

- Note: For touch-screen thermostats, use a microfiber cloth designed explicitly for electronics to avoid scratching the surface.

- Battery Replacement (Battery-Powered Thermostats Only):

-

- Signs: Dim display, inaccurate readings, or complete loss of power might indicate low battery.

- Action: Consult the user manual for your specific thermostat model to identify the correct battery type and replacement procedure. It’s recommended to keep spare batteries readily available for a quick swap.

- Leveling (For Wall-Mounted Thermostats):

- Uneven floors or settling of the building can cause a wall-mounted thermostat to become slightly misaligned.

- Action: Use a level to ensure the thermostat is perfectly horizontal. Most thermostats have small mounting screws that allow for slight adjustments. Consult the user manual for specific instructions on adjusting the level.

- Calibration:

-

- Over time, some thermostats might develop slight inaccuracies in temperature readings.

- Caution: Thermostat calibration can be delicate, and improper adjustments can lead to even greater inaccuracies.

- Action: Consult your user manual before calibration to see if your specific thermostat model allows user calibration. It’s best to leave calibration to a qualified HVAC technician if unsure.

- Inaccurate Temperature Readings:

- Cause: Dust buildup on the thermostat sensor, low battery (battery-powered models), or a malfunctioning sensor.

- Solutions: Try cleaning the thermostat sensor (consult the user manual for location) and replacing the batteries. If the issue persists, consult a qualified HVAC technician.

- Thermostat Not Responding:

-

- Cause: Tripped breaker, dead batteries (battery-powered models), or a malfunctioning thermostat.

- Solutions: Check if the HVAC system breaker has tripped. If applicable, replace the batteries. If neither resolves the issue, it might be time for a new thermostat.

Extending Thermostat Life

- Location: Avoid placing the thermostat in direct sunlight or near heat sources like lamps or vents, as this can affect temperature readings.

- Airflow: Ensure proper airflow around the thermostat. Don’t cover the thermostat with furniture, curtains, or other objects.

- Settings: Adjusting the temperature in large increments can strain your HVAC system unnecessarily. Make smaller adjustments to achieve your desired comfort level.

When To Replace Your Thermostat

- Age: Most thermostats last 10-15 years. If your thermostat is nearing the end of its lifespan and experiencing frequent issues, consider replacing it with a modern, energy-efficient model.

- Features: Modern thermostats offer advanced features like Wi-Fi connectivity, multi-stage operation, and learning capabilities that can improve comfort and energy savings. Upgrading to a newer model might be worthwhile if you desire these features.

5. Ductwork

Ductwork consists of insulated metal pipes (typically galvanized steel or sheet metal) that distribute conditioned air from your furnace or air conditioner to various rooms in your home. However, like any hidden component, it can accumulate dust, debris, and mold over time, impacting airflow and indoor air quality.

Signs of Potential Ductwork Issues

- Uneven Cooling/Heating: Rooms serviced by the same ductwork experiencing significant temperature variations might indicate blockages or leaks in the ductwork.

- Increased Dust Levels: Dust buildup around vents or a noticeable increase in dust throughout your home can indicate leaky or dirty ducts.

- High Energy Bills: A poorly maintained duct system can force your HVAC system to work harder to maintain desired temperatures, increasing energy consumption.

- Visible Mold Growth: Mold thrives in damp environments. If you suspect mold growth inside your ducts, immediate professional attention is crucial.

Best Practices For Ductwork Maintenance

- Visual Inspection: While you can’t access all sections of your ductwork, visually inspect accessible areas like crawlspaces, attics, and basements for signs of leaks, loose connections, or rodent/pest damage.

- Maintaining Duct Insulation: Proper duct insulation prevents conditioned air loss and improves system efficiency, especially in unconditioned spaces like attics or crawlspaces. Inspect the insulation for tears or gaps and address them if necessary.

- Duct Cleaning: Professional duct cleaning involves using specialized equipment to remove dust, debris, and potential mold growth from the entire duct system. This can be beneficial if you suspect significant blockages or persistent indoor air quality issues. However, it’s not always necessary, particularly for well-maintained systems.

- Duct Sealing: Leaks in the ductwork can significantly reduce system efficiency. A qualified technician can identify and seal leaks using mastic or metal tape to ensure optimal airflow.

6. Blower Fan

The unassuming blower fan is a crucial component of your HVAC system, silently yet tirelessly circulating air throughout your home. While it may seem like a simple device, proper maintenance is essential for optimal system performance and longevity.

- Components In A Blower Fan:

- Fan Blades: These blades rotate to pull and push air through the system. They are typically made of sheet metal or plastic.

- Blower Fan Motor: This motor provides the power to rotate the fan blades. There are two main types:

- PSC (Permanent Split Capacitor) Motors: The most common type, offering a balance of efficiency and affordability.

- ECM (Electronically Commutated Motors): These motors are more efficient and quieter than PSC motors but are typically more expensive. Some systems utilize variable-speed ECM blower fans for improved comfort and efficiency.

- Housing: Encases the fan blades and motor, providing structural support and directing airflow.

- Drive Belt: In some systems, a drive belt connects the motor shaft to the fan blades.

Tips For Maintaining Blower Fans

- Regular Air Filter Replacement: A clean air filter ensures optimal airflow through the system, preventing dust and debris from accumulating on the blower fan and motor. This reduces strain on the motor and improves overall system efficiency.

- Visual Inspection: Turn off the power to your HVAC system and visually inspect the blower fan for:

- Dust Buildup: Dust accumulation on the fan blades can restrict airflow and reduce efficiency.

- Visible Damage: Look for signs of damage to the fan blades, such as cracks, bends, or missing pieces. Damaged blades can create noise and vibration and should be replaced.

- Blower Fan and Motor Cleaning: A qualified HVAC technician can thoroughly clean the fan and the assembly. This includes:

- Removing Dust & Debris: The technician will carefully remove dust and debris from the fan blades, motor housing, and surrounding areas.

- Lubricating Moving Parts: Some blower fan motors have bearings that require lubrication to minimize friction and wear. The technician will use the appropriate lubricant according to the manufacturer’s specifications.

- Inspecting the Drive Belt: The technician will check the drive belt for signs of wear and tear, such as cracks, fraying, or excessive slack. A worn belt will need to be replaced.

7. Vents/Registers

Vents and registers, often overlooked heroes of your HVAC system, play a crucial role in distributing conditioned air throughout your home. Regular maintenance ensures they function optimally, delivering consistent comfort and maximizing the efficiency of your heating and cooling system.

Understanding Vents & Registers

- Types:

- Supply registers deliver conditioned air into rooms on walls, floors, or ceilings.

- Return vents draw air back to the system for recirculation, usually found on walls or floors.

- They come in various styles, like baseboards, high walls, and ceiling diffusers.

- Components:

- Register Grille: The visible portion of the vent, often made of metal or plastic. It might be louvered (adjustable slats) to direct airflow.

- Damper: A movable plate inside the ductwork that controls airflow to specific rooms (not all vents have dampers).

Tips To Vent & Register Maintenance

- Cleaning

-

- Use a vacuum cleaner with a brush attachment to remove dust and debris from the register grille.

- For stubborn dirt, remove the grille (refer to your user manual for instructions) and wash it with warm, soapy water. Dry the grille completely before reinstalling it.

- Avoid bending the grille or louvers while cleaning.

- Vacuuming Around Vents

- Use your vacuum cleaner’s hose attachment to remove dust and debris from around the vent opening. This helps prevent dust from being drawn back into the system.

- Checking Dampers

-

- If your vents have dampers, ensure they are fully open for optimal airflow.

- Adjusting dampers frequently is generally not recommended unless you’re trying to balance airflow in specific rooms. Consult your HVAC manual or a qualified technician for guidance on damper adjustments.

- Airflow Blockage: Blocked vents or registers can significantly reduce the efficiency of your HVAC system. Signs of blocked vents include uneven cooling/heating throughout your home, weak airflow from vents, and dust accumulating around vents.

- Duct Leaks: Leaks in the ductwork can also restrict airflow and reduce system efficiency. While you can’t directly inspect the ductwork itself, noticing a significant drop in airflow from vents despite clean registers might indicate duct leaks. Consider consulting a qualified HVAC technician for an inspection.

- Return Vent Placement: Ensure furniture or other objects are not blocking return vents. Restricted airflow at return vents can lead to negative pressure in your home, making it harder for the system to draw air back and potentially straining the blower fan.

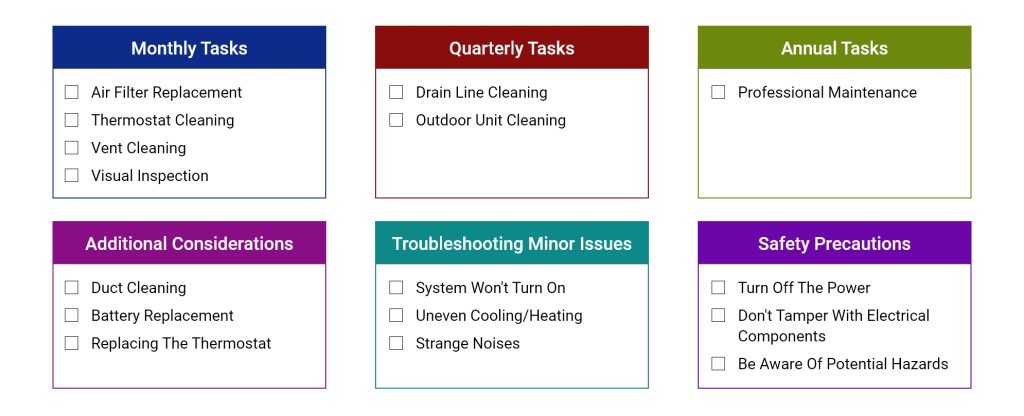

The Essential Checklist For Ultimate HVAC Maintenance

A well-maintained HVAC system is essential for year-round comfort and efficient operation. This comprehensive checklist ensures your heating and cooling system functions optimally, minimizes energy bills, and avoids costly repairs. The checklist outlines tasks categorized by frequency to help you take charge of your HVAC maintenance and create a comfortable and healthy home environment.

Monthly Tasks

- Air Filter Replacement: This is the single most crucial maintenance task. Replace your air filter according to the manufacturer’s recommendations, typically monthly for high-efficiency filters and every 2-3 months for standard filters. A clogged filter restricts airflow, reduces efficiency, and can lead to system malfunctions.

- Thermostat Cleaning: Use a soft, damp cloth to wipe down the thermostat to remove dust and debris. A dirty thermostat can lead to inaccurate temperature readings and improper system operation.

- Vent Cleaning: Vacuum the grilles of supply and return vents with a brush attachment to remove dust and debris.

- Visual Inspection: Look around vents and registers for signs of dust buildup or blockages. Check for any leaks around the furnace/boiler or AC unit (if accessible).

Quarterly Tasks

- Drain Line Cleaning: Most AC units produce condensation that drains out a condensate line. Check your user manual for the location of the drain line and clear any clogs using a wet/dry vacuum or a plumber’s snake. A clogged drain line can lead to water damage in your home.

- Outdoor Unit Cleaning: Turn off the power to your AC unit and gently remove leaves, twigs, and debris from around the outdoor unit. To remove dust buildup, you can carefully hose down the fins (avoid bending them). Proper airflow is essential for efficient operation.

Annual Tasks

- Professional Maintenance: Schedule a professional HVAC technician to inspect and clean a comprehensive system. This includes tasks like:

- Cleaning the blower fan and motor assembly

- Inspecting and tightening electrical connections

- Checking refrigerant levels (for AC units)

- Lubricating moving parts

- A professional can also identify potential problems before they become major issues.

Additional Considerations

- Duct Cleaning: Consider professional duct cleaning every 5-7 years, especially if you suspect significant blockage caused by dust, debris, or mold. Signs that might indicate a need for duct cleaning include uneven cooling/heating, allergies worsening during HVAC use, or visible dust around vents.

- Battery Replacement: Some thermostats require battery replacements. Consult your user manual for recommended replacement intervals.

- Replacing The Thermostat: Modern, programmable thermostats can improve comfort and energy efficiency. If you’re unfamiliar with electrical wiring, consider consulting a professional for installation.

Troubleshooting Minor Issues

Even with regular maintenance, minor issues can arise. Here are some common problems and potential solutions:

- System Won’t Turn On: Check the thermostat settings, ensure the circuit breaker hasn’t tripped, and replace the batteries if it’s a battery-powered thermostat.

- Uneven Cooling/Heating: Dirty air filters, clogged vents, or closed dampers can restrict airflow. Check these elements and ensure proper air circulation throughout your home.

- Strange Noises: This can indicate loose parts, failing bearings, or a clogged blower fan. These issues usually require professional attention.

Safety Precautions

Always remember safety first when working on your HVAC system:

- Turn Off The Power: Before performing any maintenance, ensure the power to your HVAC system is switched off at the breaker box.

- Don’t Tamper With Electrical Components: Leave electrical work to qualified professionals.

- Be Aware Of Potential Hazards: Look out for sharp edges, exposed wiring, or hot surfaces while cleaning or inspecting the system..

Home Warranty and HVAC Maintenance: Understanding the Coverage

Home warranties and HVAC maintenance plans serve distinct purposes in protecting your home’s comfort system. Here’s a breakdown to help you understand the coverage:

- Function: Provides financial protection against unexpected breakdowns and repairs of covered appliances and systems in your home, potentially including your HVAC system (depending on the plan).

- Coverage: Home warranties typically cover major components of your HVAC system, such as the compressor, furnace heat exchanger, blower motor, and electrical controls. However, coverage details and exclusions vary significantly between providers.

- Maintenance: Home warranty plans generally do not cover routine maintenance tasks like air filter replacement, cleaning, or annual system inspections. Your responsibility remains to ensure your HVAC system operates efficiently and avoids potential breakdowns.

- Costs: Home warranty plans come with annual premiums and may also have service call fees when requesting repairs.

Key Considerations

- Read the Fine Print: Carefully review the terms and conditions of your home warranty plan. This will ensure you understand what’s covered, what exclusions exist, and any associated costs.

- Complementary Services: While a home warranty might cover repairs after a breakdown, an HVAC maintenance plan can help prevent breakdowns. Consider both services complementary approaches to protecting your HVAC system.

- DIY vs. Professional Maintenance: Some basic maintenance tasks, like air filter replacement, can be done yourself. However, consult a qualified HVAC technician for tasks requiring technical expertise to ensure proper system function and avoid accidentally voiding your home warranty.

Final Word

By reaching the end of this guide, you've equipped yourself with the knowledge and tools to become a proactive HVAC maintenance champion. Remember, a well-maintained HVAC system ensures year-round comfort and translates to efficient operation, potentially lower energy bills, and a longer lifespan for your investment. With this newfound knowledge, you can confidently take control of your home's comfort and breathe easy throughout the seasons.