With 11 years of experience, Select Home Warranty provides customers with three different home warranty coverage plans across 47 states. Its plans include coverage for systems, appliances, and a mix. Each plan also includes free roof coverage and several add-on options.

Based on 4,550+ customer reviews and primary company data, our editorial team has created this Select Home Warranty review to assist with the following components:

- Coverage and cost of Select Home Warranty’s plans

- Inclusion and exclusion of items in various plans of the company

- Claim-related details of the company

Why Select Home Warranty?

SHW provides round-the-clock support and responds within 24 hours on claims

The company protects your repairs for 90 days

SHW is well-known for its impressive contractor network

The company maintains affordability by offering regular discounts

Explore Verified Consumer Reviews for Select Home Warranty

Although I didn’t have to use this warranty, it looks like it will cover everything I need except for my water softener system.

Had policy for two years finally filed a claim for my AC unit. At first it was denied due to a renewal timing thing so being ticked, I asked for a refund and to cancel my plan and posted a bad review. The following business day, I received a call and speaking with their representative and explaining the situation it was approved quickly. Thus I am changing my review from bad to great as they came through and I am 100% satisfied with the outcome. They allowed me to call any company I wanted which was great as I was able to get a repairman quickly. I submitted the invoice and they approved it right away so again, I strongly recommend Select Home Warranty!

The automated system works very well. I received a response right away and and a notice that a repairman should notify me within 48 hours. Overall SWH is a great company to work with.

This was my 1st claim I started my coverage approximately 90 days ago Repair person In process of being scheduled. But I would like to say is the customer service I received from the representative was awesome! She made everything more than Convenient

I was treated politely and the person was knowledgeable. I was given instructions for what to do if I wanted to use my own service technician. I was glad I could use my local technician.

I really enjoyed the warranty buying process with this vendor. The sales rep was knowledgable and very easy to work with. He was also prompt with all communications. The plan is itself is also a lot better bang for my buck compared to other vendors.

Pros & cons

Pros

- Cost-Effective and affordable Plans

- Free Roof Leak Coverage Included

- Fast claims processing ensures quick repair

Cons

- Lower dollar limits for appliances

Enquire For Cost-effective home warranty plans

Protect Your Home Appliances And Systems Starting As Low As $1.5/Day

Plans & Coverage of Select Home Warranty

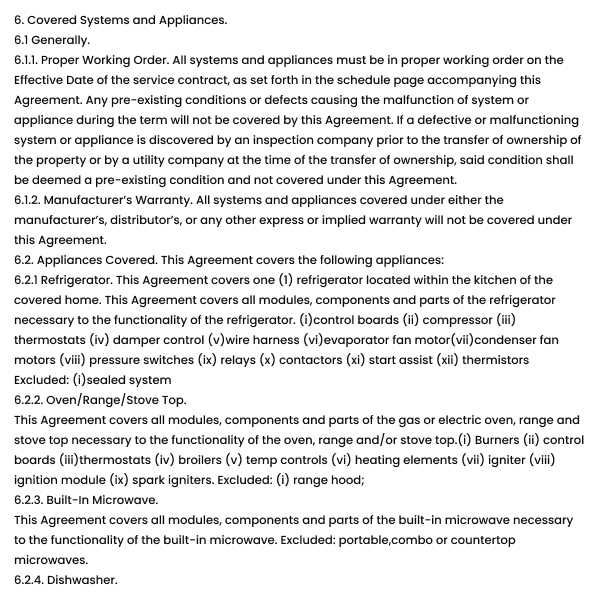

There are 3 Select Home Warranty plans available for homeowners – Bronze Care, Gold Care, and Platinum Care. The Bronze Care and Gold Care plans cover appliances and systems, respectively, while the Platinum Care is the combinational option comprising items from both plans.

- Bronze Care covers eight major home appliances, including a clothes washer, dishwasher, oven, etc.

- Gold Care covers six essential home systems: heating, electrical, plumbing, etc.

- Platinum Care covers 17 items, including everything from the other two plans, plus plumbing stoppages, ceiling fans, and garage door openers.

The plans offer considerable coverage and include items that most homeowners use. Look at the table to understand Select Home Warranty coverage in detail:

| Items Included | Bronze Care | Gold Care | Platinum Care |

|

Clothes Washer |

✓ |

✓ |

|

|

Garbage Disposal |

✓ |

✓ |

|

|

Refrigerator |

✓ |

✓ |

|

|

Stove/Oven |

✓ |

✓ |

|

|

Microwave Oven(Built-In) |

✓ |

✓ |

|

|

Clothes Dryer |

✓ |

✓ |

|

|

Cooktop |

✓ |

✓ |

|

|

Dishwasher |

✓ |

✓ |

|

|

A/C |

✓ |

✓ |

|

|

Cooling |

✓ |

✓ |

|

|

Plumbing System |

✓ |

✓ |

|

|

Heating System |

✓ |

✓ |

|

|

Electrical System |

✓ |

✓ |

|

|

Water Heater |

✓ |

✓ |

|

|

Ductwork |

✓ |

✓ |

|

|

Plumbing Stoppage |

✓ |

||

|

Garage Door Openers |

✓ |

||

|

Ceiling Fan |

✓ |

Select Home Warranty offers 3 plans for parties involved in real estate transactions – Home Buyers Plan, Sellers Plan, and Realtors Plan. These plans are available for a term ranging from 1-5 years.

Optional Coverage

Select Home Warranty offers the following items as optional coverage at an additional cost, as listed below:

|

Add-On Items |

Cost ($) |

|

Central Vacuum |

$3.33/mo |

|

Roof Leak |

Free Coverage |

|

Stand Alone Freezer |

$3.33/mo |

|

Lawn Sprinkler System |

$5.83/mo |

|

Septic System |

$5.83/mo |

|

Sump Pump |

$3.33/mo |

|

Pool |

$8.33/mo |

|

Spa |

$5.83/mo |

|

Well Pump |

$3.33/mo |

Image description: Select Home Warranty Coverage From Select Home Warranty Sample Contract

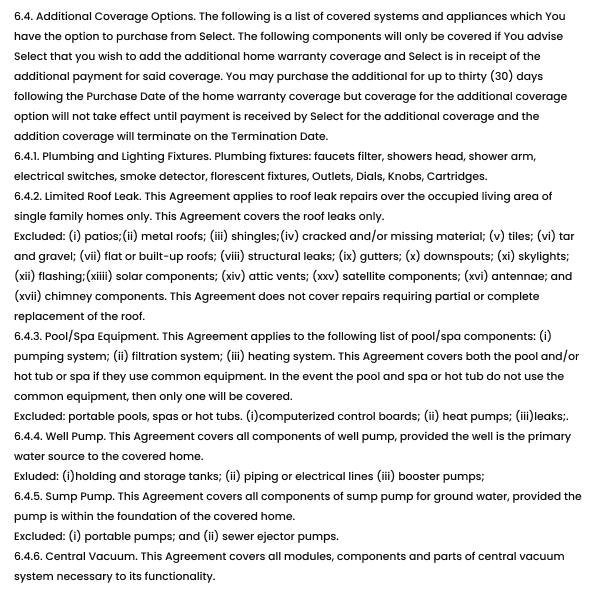

Coverage Limitations & Exclusions

Select Home Warranty coverage provides an overall limit of $2000 for essential appliances and systems. However, some systems and appliances have specific coverage limits, which are mentioned below:

|

Items |

Limits |

|

HVAC (Heating & Cooling Equipment) System |

$3000 |

|

Plumbing & Electrical Systems |

$500 |

|

Appliances |

$500 |

|

Optional Add-Ons |

$400 |

|

Freon (If Added As Optional Item) |

$200 |

You should remember that any amount exceeding the limit is payable by you. To know what’s covered and what’s not in your home warranty policy, carefully read the fine print.

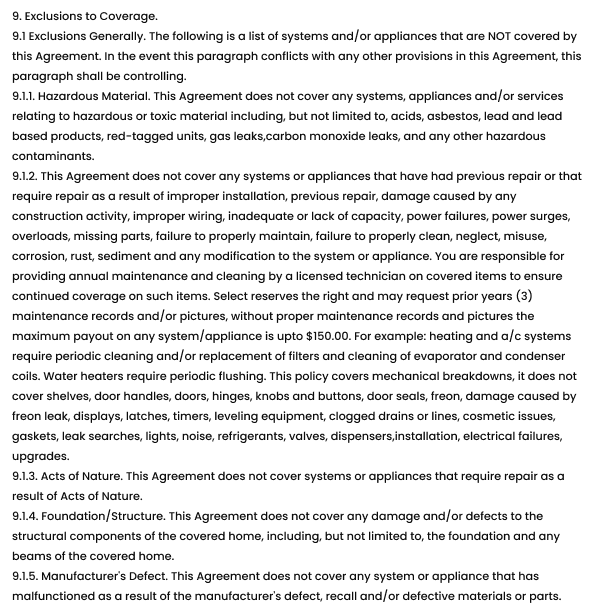

Select Home Warranty excludes certain items from offering coverage if:

- Appliances and systems break down due to lack of maintenance, neglect, abuse, natural calamities, or other factors.

- Generally, not all parts and components of your items are covered. Some components of an appliance or system may not be covered as per the contract.

We recommend you read the contract carefully to know what is covered and what’s not to be properly informed before purchasing.

Image description: Select Home Warranty Exclusions From Select Home Warranty Sample Contract

Select Home Warranty Cost

Select Home Warranty offers 3 plans – Bronze Care, Gold Care & Platinum Care.

Bronze Care and Gold Care of Select Home Warranty costs $44.42/month, respectively, while the Platinum Care costs $47.75 monthly.

In summary, the cost details of Select Home Warranty are expressed in the table below:

|

Plan |

Cost/Month |

Cost/Annum |

|

Bronze Care |

$44.42 |

$479.99 |

|

Gold Care |

$44.42 |

$479.99 |

|

Platinum Care |

$47.75 |

$524.99 |

|

Deductible : $60-$75 |

||

In addition to premiums, you may incur a service call fee or deductible ranging from $60 to $75, payable to technicians for diagnosis and repairs during their visit.

Note: Select Home Warranty’s costs can change due to certain factors. These include your residence, the add-ons you choose, and more.

Review Of Plans, Coverage & Customer Service Of Select Home Warranty

Select Home Warranty has received a rating of 3.5 out of 5 on our platform based on over 4,500 customer reviews. Customers have praised the Select Home Warranty customer service team and the affordable cost of the combo plan. The company has also received a 3.9 on 5 on Google Reviews.

Review Of Select Home Warranty Plans & Coverage

- Select Home Warranty suits those seeking comprehensive coverage at a reasonable price point. The simplicity of the policy is a bonus for its customers.

- SHW stands out for its competitive pricing, making it an attractive option for budget-conscious customers seeking reliable coverage.

Review Of Select Home Warranty’s Customer Services

- SHW has attracted many customers due to its competitive pricing and enthusiastic team. The company’s long-standing reputation indicates that its customer service has been reasonable.

- Recent reviews have highlighted concerns regarding declining claim requests and service delays, even though Select Home Warranty complaints are addressed within three days.

Select Home Warranty’s Claim Filing Procedure: Phone Number, Web Portal, & Online Form

Here is how Select Home Warranty claims are handled:

- Call Select Home Warranty customer service number [855-267-3532], as they are available 24/7, to initiate the claim filing process.

- You can file a claim for repair and replacement within three days of discovering the malfunction.

- Once your claim is submitted, Select Home Warranty assigns an independent service technician to repair your item.

- Repairs are typically completed within two business days during the week and four business days over the weekend.

- Authorization from SHW is necessary if you want your technician to repair your system/appliance.

- You are responsible for paying the service call fee to the company or the contractor. However, the company will cover the cost of repair or replacement.

Conclusion

Our advice to the readers considering Select Home Warranty is to be clear on what you expect from the company. Certain companies hold distinctions in certain aspects of the business. Select’s distinction is its price point and its service team. Still, it lags in claims-related matters in certain locations.

Ensure you ask for a claim settlement rate while interacting with the company. Also, ensure that you have read the entire contract end-to-end and understand the nitty-gritty of the contract so that you have the required clarity.

Quick Details About The Company

Look at the following table to know some basic details about Select Home Warranty:

|

Founder |

Joseph Scott Shrem, CEO |

|

Year Of Establishment |

2012 |

|

Address |

1 International Blvd, Mahwah, NJ 07495-0025 |

|

Type Of Company |

Corporation |

Why Should You Trust Us?

- We thoroughly analyzed Select Home Warranty's coverage terms to streamline and enhance their descriptions.

- Our assessment encompassed analyzing over 6,550 genuine customer reviews across various platforms to understand customers' concerns and viewpoints.

- This thorough review results from 31 hours of extensive research dedicated to comprehending every aspect of the company.

- All the information provided in this review is directly sourced from Select Home Warranty's official page and their sample contract.

Frequently Asked Questions (FAQs)

Is Select Home Warranty Legit?

A.

Select Home Warranty has been a prominent player in the home warranty industry since 2012. They are a registered company with licenses and permits required to operate in the states where it conducts business. Where does Select Home Warranty Offer Services?

You can get Select’s services in 47 U.S. states. It does not operate in Nevada, Washington, and Wisconsin.

Can I Renew My Select Home Warranty Contract?

A.

Yes, you can renew your Select Home Warranty contract without any hassle. The company will notify you to extend your plan before the expiration of your contract. You could opt for the same or upgrade to a more comprehensive plan. You just have to inform the representatives.

Which Is Better, American Home Shield Or Select Home Warranty?

A.

On the one hand, AHS is a pioneer in the home warranty industry, and on the other hand, SHW is a relative newcomer, yet both companies are popular with customers. Where American Home Shield extends coverage to more items, Select makes up for it by offering more optional items.

The pricing comparison of these companies leans in favor of AHS, but Select regularly runs discounts to make prices affordable.

Is Select Home Warranty Transferable?

A.

You can transfer your Select Home Warranty policy if needed. All you need to do is dial 855-267-3532. Once you connect with the representative, state the reason for the transfer of ownership to initiate the process.

What Is The Cancellation Policy Of Select Home Warranty?

A.

The Select Home Warranty’s cancellation policy states that you can receive a full refund if you cancel the policy within 30 days of purchasing the plan. If you cancel your policy after 30 days, you may be eligible for a refund with special permission from the company. You may also be entitled to pay a cancellation fee of $75.

Does Select Home Warranty Cover Older Systems And Appliances?

A.

Yes, Select Home Warranty covers older systems and appliances as long as they are in good working order while purchasing the plan. The company does not conduct any home inspection before the contract is signed. However, it is a general rule that customers must always try to keep their systems and appliances in good working condition.

What Is Offered Under Select's Free Roof Leak Coverage?

A.

Select’s free roof leak coverage includes leaks only over the occupied living area of single-family homes. Coverage does not include roof replacements or patios, shingles, metallic roofs, tars, flat roofs, structural repairs, tiles, gravel, gutters, downspouts, skylights, solar heating systems, panels, and flashing satellite components, antennae, attic vents, chimney, etc.

What Components Does My Warranty Cover In An Air Conditioning Unit?

A.

Select Home Warranty protects the central floor air conditioning unit of the home. The components include condenser fan motors, compressors, transformers, thermostats, capacitors, contactors, pressure switches, thermistors, cut-in switches, condensers, defrost boards, relays, and blower motors.

Will Select Home Warranty Replace The HVAC System?

A.

If Select cannot repair the HVAC system or deems it a better option to get a new unit, they may offer a replacement with a functionally equivalent new unit. Alternatively, they may offer a reimbursement equivalent to the depreciated value of the unit, subject to maximum payout limits.

Is Homeowners Insurance The Same As Home Warranty?

A.

Not at all. Homeowners’ insurance is legally recognized as insurance and is meant to cover people from the liabilities of specified events such as fire damage, loss of property, etc. A home warranty is legally a service contract, not an insurance policy. But, it does ‘insure,’ so to speak, against expensive repairs due to mechanical wearing out of home systems and appliances.

How Long Does Select Home Warranty Take To Repair Systems/Appliance?

A.

Reviews for Select Home Warranty suggest that usually, the company sends a service contractor within two working days on weekdays and four working days on weekends. However, these numbers may vary from case to case. The contractor estimates how long the repairs will take, usually under a week.

Can I Choose My Service Provider With Select Home Warranty?

A.

Select Home Warranty dispatch technicians to your home at your convenience. Select must give you the approval to choose your service provider to cover such repairs.

Where does Select Home Warranty Offer Services?

A.

You can get Select’s services in 47 U.S. states. It does not operate in Nevada, Washington, and Wisconsin.

Does Select Home Warranty provide any discounts?

A.

To make plans more affordable for customers, Select regularly runs discounts. The company offers $150 off, free two-month coverage, and accessible roof coverage for up to $99 on its annual plans. It also provides deals on monthly billed plans.

You May Also Be Interested In

Customer Reviews On Select Home Warranty

Check out what existing customers are saying about Select Home Warranty.

Home Warranty Blogs

Ever thought about getting a home warranty? It’s a big deal to p ...

Did you know over 26,000 complaints have been filed against American H ...

Imagine moving into your dream home, a place you’ve always wante ...